When it comes to building a high-performing go-to-market strategy, one of the most important – and most overlooked – foundations is a clearly defined Ideal Customer Profile (ICP).

Too often, SMEs try to sell to “everyone” and end up resonating with no one. Or they take a guess at who their ICP might be, without validating it with real data. The result? Wasted budget, bloated pipelines filled with poor-fit leads, and campaigns that fall flat.

In today’s data-rich, attention-poor environment, understanding who your best-fit customers really are — and how to reach them — is crucial for cutting through the noise and converting faster.

In this blog, we’ll walk you through five practical, proven steps to define your ICP, backed by real-world examples and industry data. Whether you’re refining your marketing strategy or building one from scratch, this guide will help you focus your efforts, align your teams, and maximise your marketing ROI.

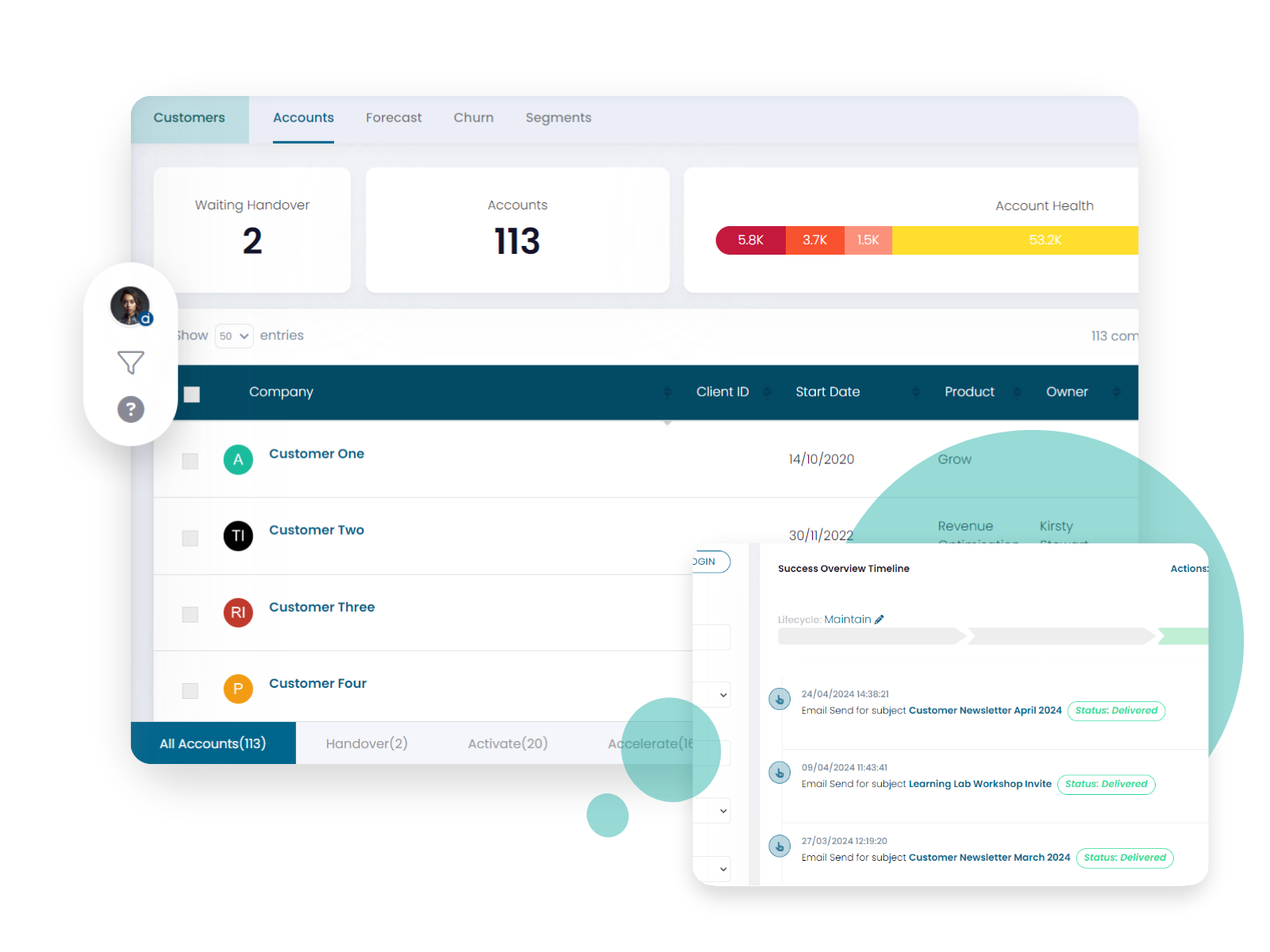

Step 1: Analyse Your Best Customers

Start by looking inward. Who are your top 10–20 customers right now? These are the ones who:

- Spend the most over time

- Require the least hand-holding

- Renew without hesitation

- Refer others to your business

Dig into the data. What industries do they come from? What’s their company size, geography, revenue, tech stack, or growth stage? For example, if 70% of your top spenders are mid-sized recruitment firms with 50–200 employees using LinkedIn heavily, that’s a valuable insight.

Step 2: Talk to Your Top Customers

Quantitative data is great – but qualitative insight is where the gold is. Have real conversations with your best customers. Ask them:

- Why did you choose us?

- What nearly stopped you from buying?

- What alternatives did you consider?

- What specific outcomes have you achieved?

These conversations help uncover emotional triggers and decision-making dynamics. One customer might say, “We loved how quick your onboarding was – others seemed clunky.” That’s a positioning nugget.

Step 3: Study Who Didn’t Convert

Just as important as who did buy is who didn’t. Look at:

- Leads who booked a demo but never followed up

- Trials that didn’t convert

- Customers who churned within 90 days

What do they have in common? Maybe they’re all early-stage startups with limited budgets or companies from industries with long, bureaucratic buying cycles. Knowing who isn’t a fit helps you filter out time-wasters early and focus your resources.

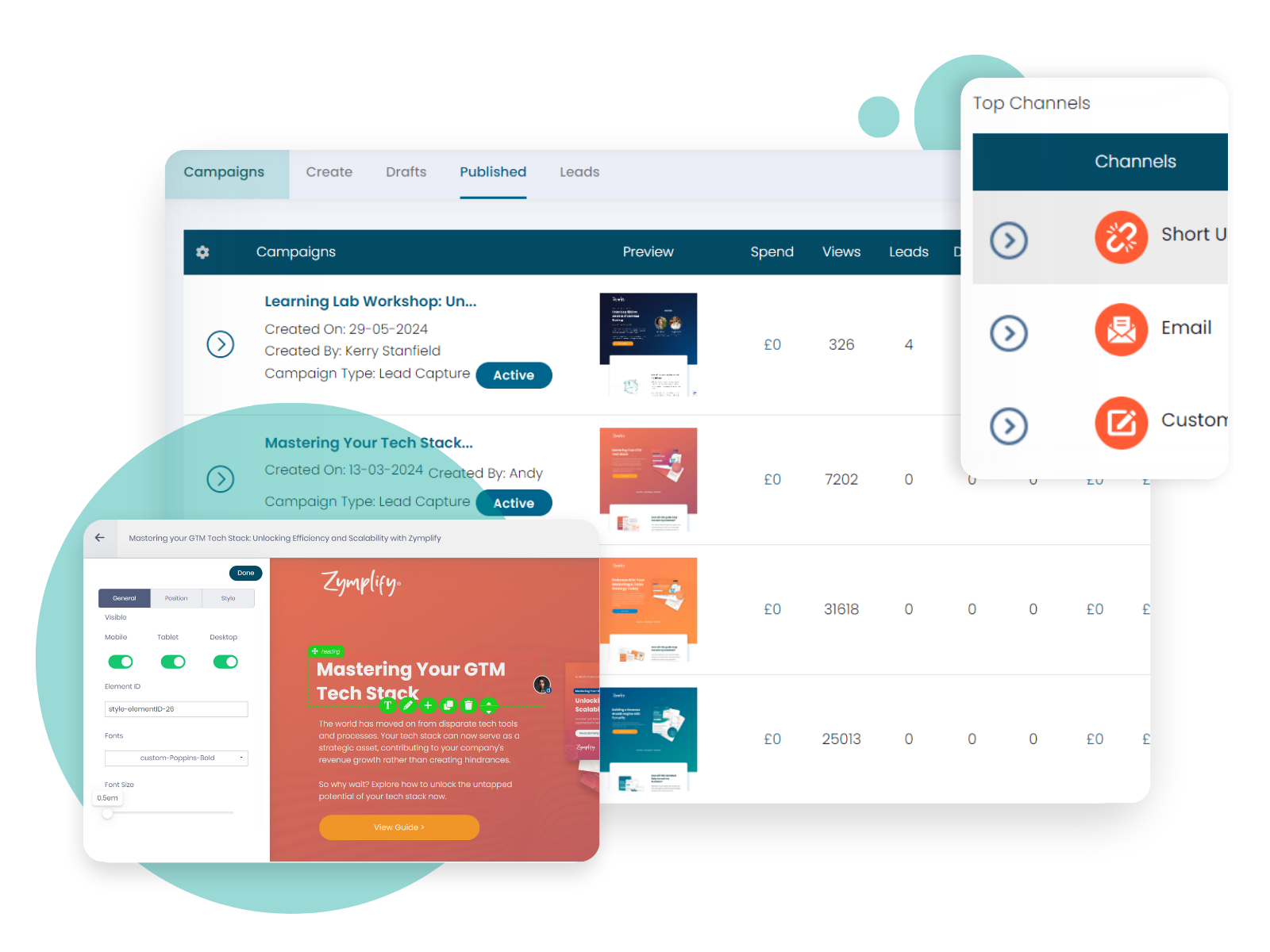

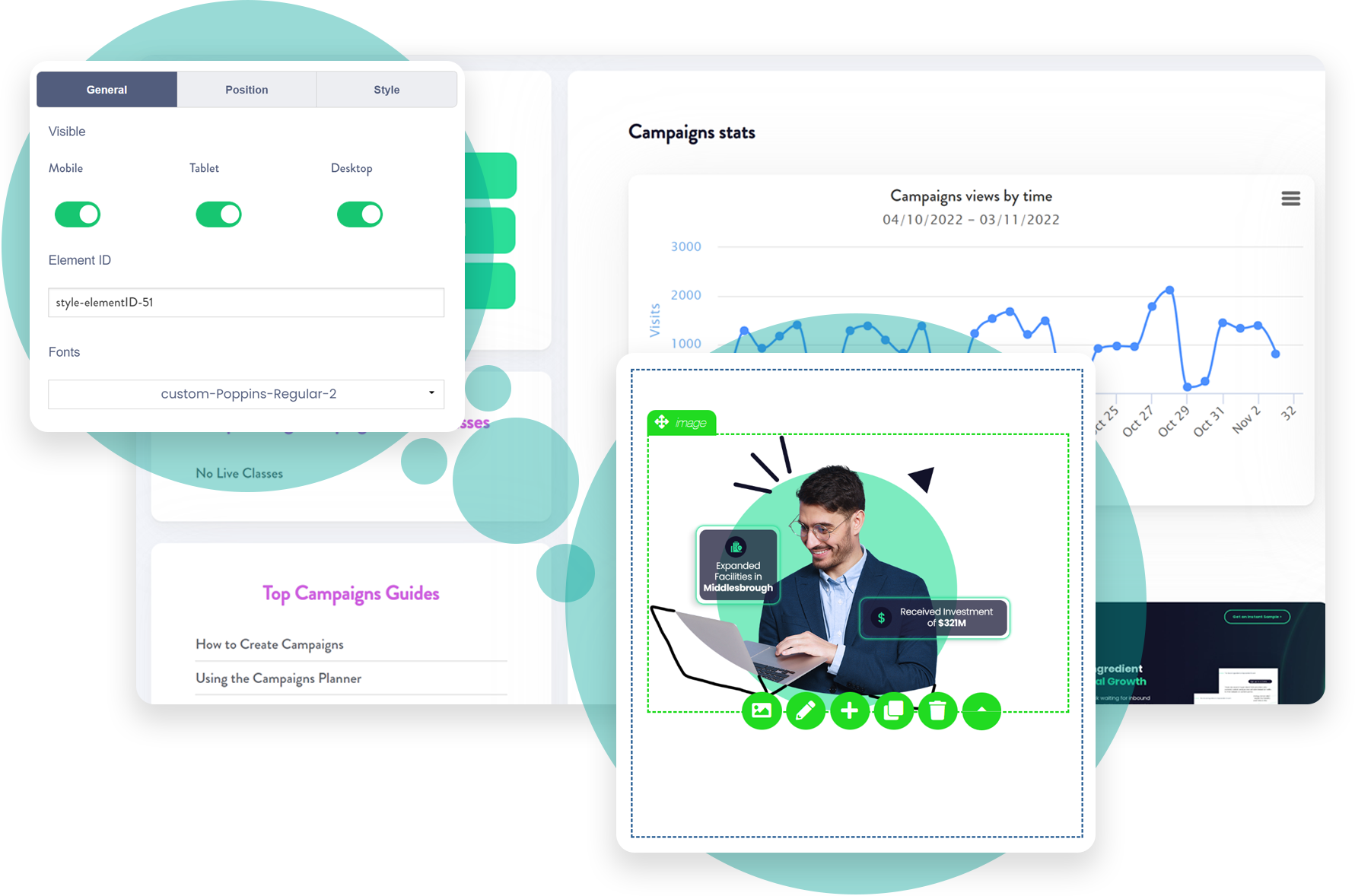

Step 4: Test Small Ad Campaigns

Once you’ve identified 2–3 potential ICP segments, test them. Run small, tightly targeted paid campaigns (on LinkedIn, Meta, or Google) with content tailored to each segment. Then track:

- Click-through rates (CTR)

- Cost-per-lead (CPL)

- Conversion rates

For instance, you might find that “HR decision-makers in FinTech firms” engage more and convert faster than “general operations leads in professional services.”

Step 5: Build Test Funnels for Each Segment

Still not 100% sure? Build a simple funnel for each of your ICP options:

- TOF blog content or webinar (educational)

- A use-case landing page

- A compelling case study

- A clear call to action (e.g. “Book a free strategy session”)

Push each funnel to its respective audience and monitor results over 2–4 weeks. The funnel with the highest engagement and lowest cost per acquisition usually points to your best-fit ICP.

Why Getting Your ICP Right Matters

According to McKinsey, companies that adopt a customer-led growth model – one that starts with knowing exactly who their customer is – grow 2–3x faster than their competitors. And Gartner reports that companies using well-defined ICPs see 68% better conversion rates in B2B marketing.

Final Thoughts

As an SME, you don’t have the luxury of endless budget or massive headcount. Every pound must move the needle. Defining your ICP with clarity and using it to power your go-to-market strategy ensures your team is working smarter, not harder.

✅ Use your data.

✅ Back it up with real conversations.

✅ Test, refine, repeat.

And if you want a head start…