Most B2B teams focus their energy on a known list of target accounts.

They’re often based on past wins, firmographic fit, or a sales rep’s gut feel.

But here’s the problem:

📉 You can only sell to the accounts you can see — and in a fast-moving market, that means you’re missing huge opportunities.

Buyers are out there right now, actively researching solutions like yours, who have never engaged with your brand. Some aren’t even on your radar. If your demand generation strategy only works within a pre-set list, you’re leaving revenue on the table.

This is where TAM discovery and enrichment come in. With the right intent data, you can uncover hidden demand — buyers who fit your Ideal Customer Profile (ICP), are in-market today, and can be reached with personalised, timely outreach.

In this blog, we’ll cover:

- Why traditional TAM lists are incomplete

- How intent data uncovers net-new opportunities

- What enrichment does to improve conversion rates

- Steps to start expanding your TAM today

1. Why Traditional TAM Lists Leave Gaps

Your Total Addressable Market (TAM) is the universe of companies that could buy from you. On paper, it sounds straightforward — but in practice, most teams work from a shrunk-down version of it.

Here’s why:

- Reliance on inbound – If you’re only engaging the companies that fill out a form or attend a webinar, you’re only seeing a small fraction of your real TAM.

- Static account lists – Many teams build a list of accounts once and rarely update it. In dynamic industries, this means your TAM gets outdated fast.

- Data blind spots – Without the right data coverage, you miss companies in growth mode, entering your market, or actively researching competitors.

In fact, Forrester research shows that 62% of B2B buying teams engage with multiple vendors before contacting any sales rep — meaning if you’re not proactively identifying them early, you’ll never get into the deal.

2. How Intent Data Finds the Buyers You’ve Missed

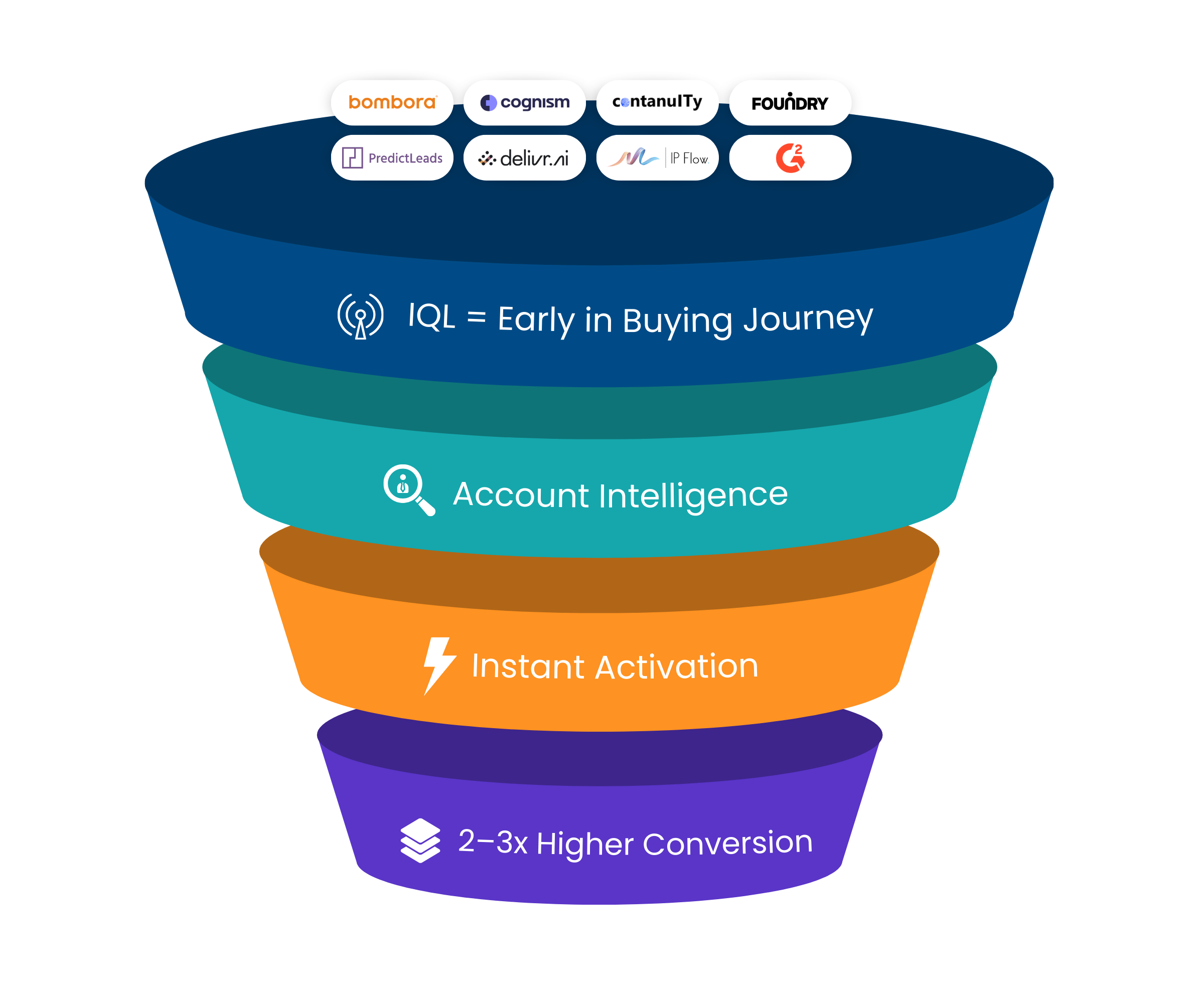

Intent data flips the traditional TAM approach on its head. Instead of waiting for accounts to raise their hand, you proactively find those showing buying signals right now.

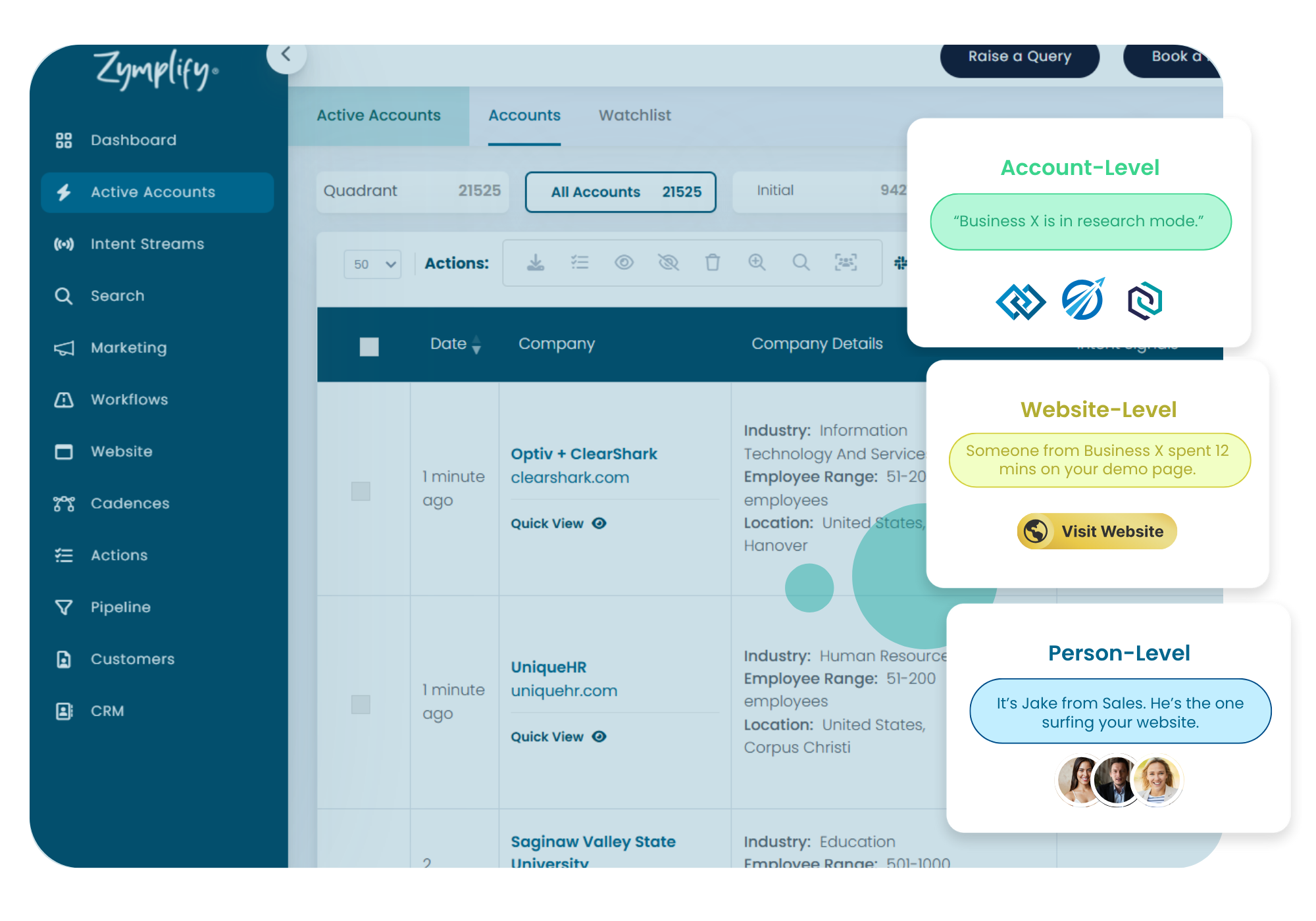

Here’s how Zymplify’s multi-source intent identifies hidden buyers:

a. Multiple intent sources for complete coverage

Zymplify combines 20+ feeds — from review sites, content consumption, search behaviour, funding alerts, hiring data, and more.

Where single-source intent might show one or two active accounts, multi-source reveals the full picture.

b. Signal scoring for prioritisation

Not all signals are equal. A blog view might indicate light research, while multiple product comparison page visits or competitor reviews are stronger buying cues.

Zymplify scores accounts based on signal density, recency, and type to surface the ones most ready to engage.

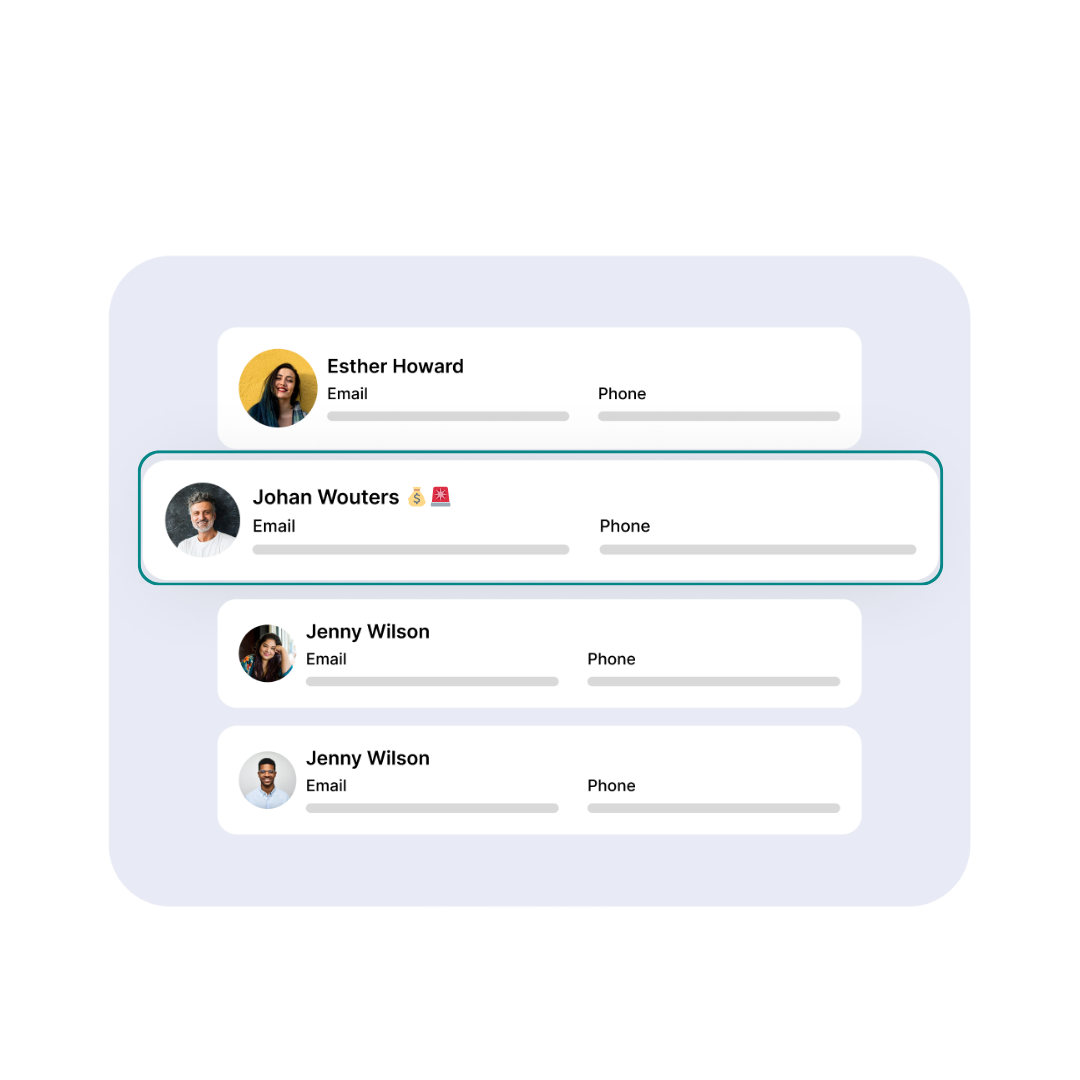

c. Account + contact-level insights

Many intent tools stop at the company level. Zymplify goes further, identifying decision-makers within those accounts so you can start outreach immediately.

Example:

If a mid-sized SaaS company you’ve never engaged starts researching “ABM automation platforms” across three channels and one of their marketing directors visits your pricing page, Zymplify flags them as a net-new Intent Qualified Lead (IQL) — ready for targeted outreach.

3. Why Enrichment Is the Secret to Higher Conversions

Finding new accounts is just step one. To actually convert them into pipeline, you need enriched, accurate data.

Enrichment adds:

- Verified contact details for decision-makers

- Firmographic data like revenue, employee size, tech stack

- Contextual insights like recent funding, location, and hiring trends

This matters because:

- SDRs spend less time researching and more time selling

- Outreach is personalised and relevant to the buyer’s situation

- Campaigns are segmented and targeted with precision

According to LinkedIn’s State of Sales report, top-performing sales teams are 58% more likely to use data to identify new opportunities — and those using enriched data see faster conversions.

4. How to Start Expanding Your TAM Today

You don’t need a huge team or budget to start finding hidden buyers. Here’s a simple roadmap:

Step 1 – Define your ICP clearly

Know the industries, sizes, geographies, and job titles that matter most.

Step 2 – Activate multi-source intent data

The more feeds, the better. Single-source will always leave blind spots.

Step 3 – Apply scoring rules

Prioritise accounts with multiple, recent, high-value intent signals.

Step 4 – Enrich your data

Get the right contacts and firmographic details before outreach.

Step 5 – Launch targeted outreach

Personalise messaging based on the intent triggers you’ve seen.

The Bottom Line

If you’re still relying on static account lists or inbound-only leads, you’re competing for the same small pool of visible buyers as everyone else.

With TAM discovery and enrichment, you can:

- Spot in-market accounts before your competitors do

- Add net-new, high-quality prospects to your funnel

- Engage faster with personalised, relevant outreach.

Your future customers are out there — even if they’ve never heard of you. The only question is: will you find them before someone else does?

🎯 Don’t let your next best customer stay invisible.

The buyers you haven’t discovered yet are already researching solutions like yours — and they won’t wait around.

With Zymplify’s GTM Agent, you can spot them the moment they enter the market, enrich their profiles, and engage before your competitors even know they exist.

Try it free today and start uncovering revenue you didn’t even know was in your TAM.

👉 https://d36.co/1bV1m