The hidden cost of a half-open radar

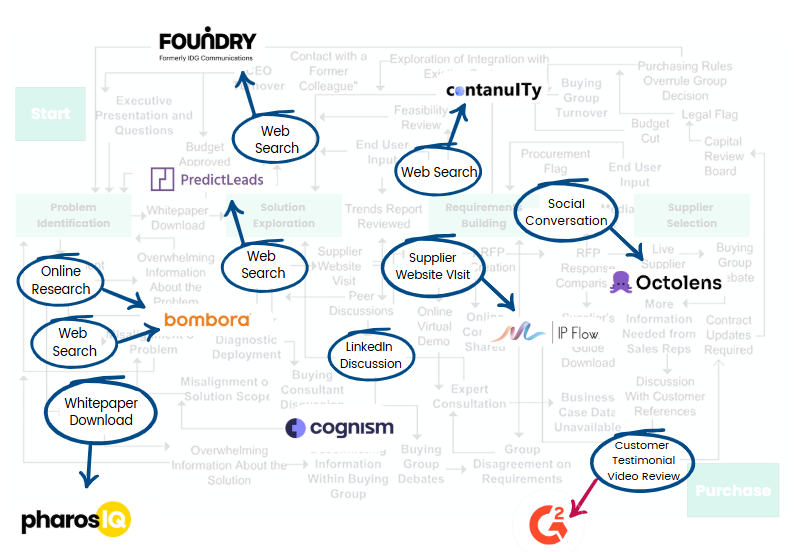

If your team relies on a single intent source (e.g. one publisher network, one review site, or one ad platform), you’re seeing only a fraction of the buyer’s journey. Buyers don’t research linearly or in one place; they bounce between publisher articles, comparison sites, communities, ads, and your website — often long before they ever fill in a form.

A single source can’t capture that behaviour, which creates blind spots: you miss real buyers, you spot them too late, or you mistake noise for signal.

The fix isn’t “more data for the sake of it.” It’s a multi-source intent model that stitches together diverse, complementary signals into a single view, scored by fit and intensity, and activated in real time. That’s how you find more in-market buyers earlier — and convert them faster.

What we mean by single-source intent (and why it’s risky)

“Single-source” means your view of buying intent comes from one provider or one signal type. Typical examples:

- Review sites (e.g. category or competitor page visits)

- Publisher/content networks (topic consumption and surge patterns)

- Events & webinars (attendance/registrations)

- Ad networks (engagement, retargeting activity)

Each can be useful — and each has baked-in limitations:

- Review sites = late stage. You only see buyers once they’ve started vendor shortlisting.

- Publisher networks = early, but incomplete. You miss researchers who skip gated content or prefer peer communities.

- Events = episodic. Great contextual signal, but seasonal and narrow.

- Ad network data = intent-ish. Clicks show curiosity, not necessarily buying readiness.

Relying on a single lens makes your pipeline fragile: you’ll get false negatives (you miss buyers entirely), false positives (interest that doesn’t equal intent), and timing gaps (you discover interest after competitors have engaged).

The multi-source advantage: a 360° view of real buyers

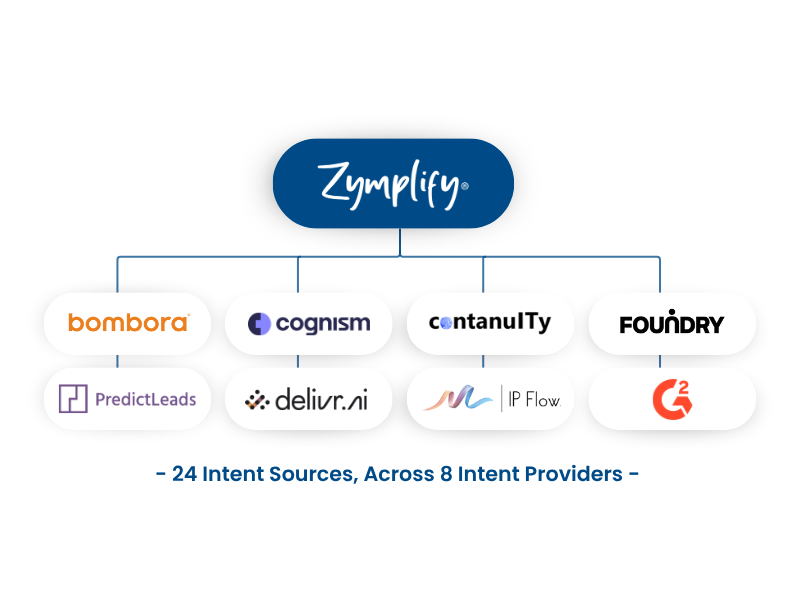

A multi-source approach complements each signal’s strengths and cancels out weaknesses. In Zymplify, we bring together 20+ sources, such as:

- Third-party research intent: topic consumption, competitor comparisons, category reading patterns across publisher networks.

- Review site activity: repeat visits to vendor pages, pricing comparisons, and category shortlist signals.

- Trigger events: funding rounds, leadership hires, rapid vacancies, technology installs/changes — indicators of budget, urgency, or new priorities.

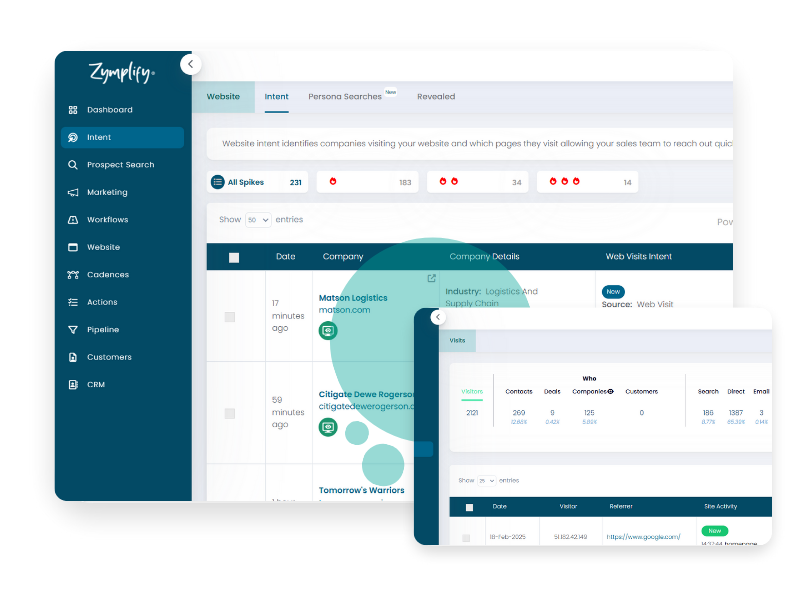

- First-party website behaviour: known and de-anonymised company visits, high-intent page views (pricing, integrations, demo), frequency and recency.

- CRM & MAP engagement: email opens/clicks, webinar attendance, form fills — woven back into the same identity.

- Social and community signals: topical engagement trends that support (not replace) primary sources.

When these signals converge, you don’t just see that an account is warm — you understand why, who, and how to act.

A practical timeline: multi-source vs single-source

Imagine you sell to mid-market SaaS. Multi-source view (what Zymplify surfaces):

- Week 1: The VP Sales reads three “sales automation” articles (publisher network).

- Week 2: The company installs a new CRM add-on (tech trigger) and your pixel sees two visits to your “Features” page (first-party).

- Week 3: The team compares two competitors on a review site and your “Pricing” page gets a second visit (review + first-party).

- Action: Zymplify scores the company as high intent + high fit, auto-enrols them in a tailored email/ad sequence, and alerts an SDR with context. Discovery call booked this week.

Single-source view (review site only):

- Week 3: You first notice when they land on a competitor page.

- Action: You reach out after they’ve started shortlisting — i.e. late.

Early signal convergence beats late-stage discovery almost every time.

From signal to shortlist: how prioritisation actually works

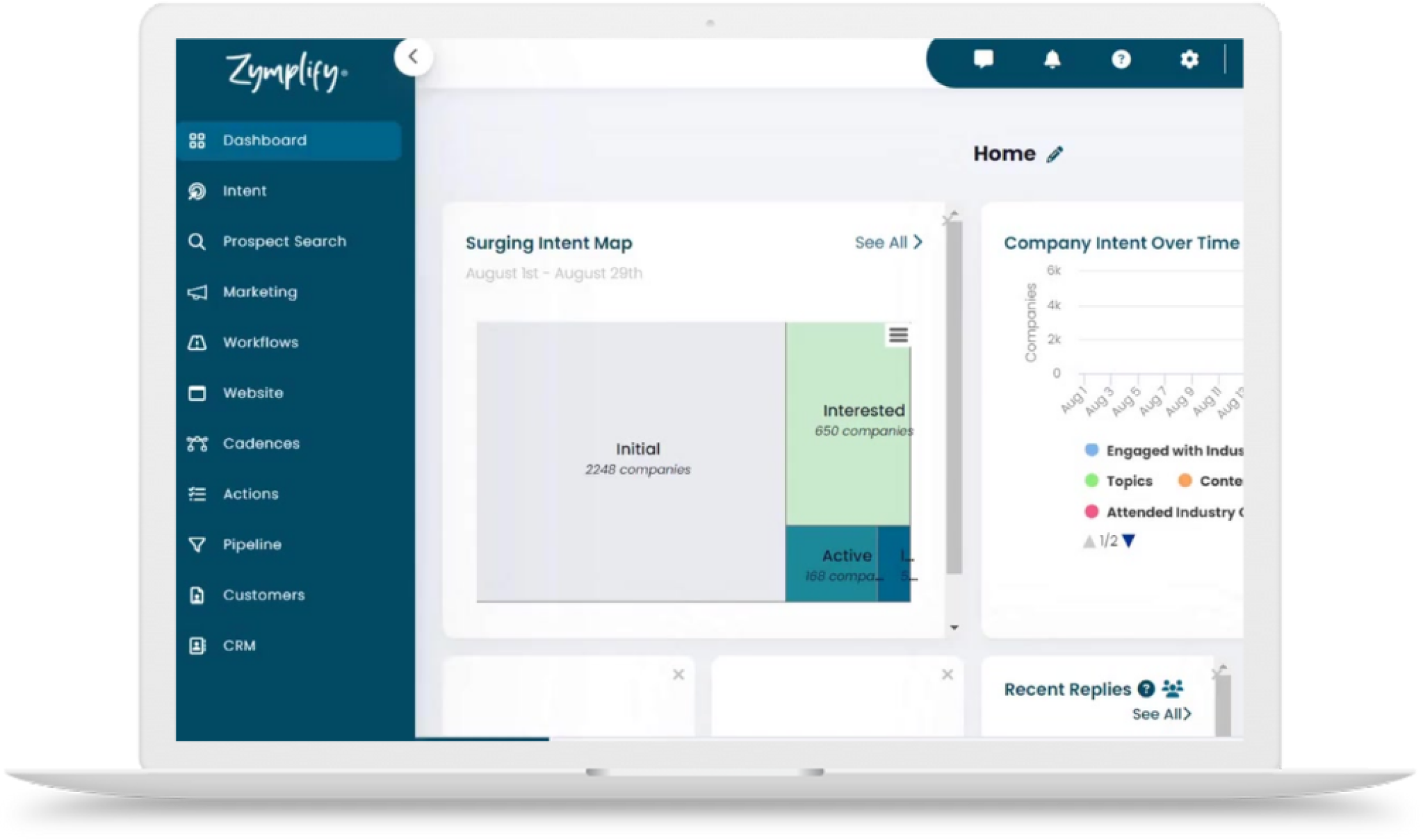

More sources aren’t helpful unless you can prioritise quickly. Zymplify plots every account in the Research Quadrant™ using two axes:

- Intent intensity (surge strength, signal density, and freshness)

- Account fit (ICP match: firmographics, technographics, historical win patterns)

Accounts in the top-right (high intent/ interested) become IQLs (Intent Qualified Leads) and flow straight into activation:

- IQL → Auto-trigger personalised journeys (email, paid, social).

- MQL → On engagement (visit, click, reply), they become marketing-qualified with proof of brand interest.

- SQL → Sales gets a timed alert with the intent story (topics, competitors, pages viewed), so outreach is contextual and timely.

This scoring/visualisation step is what turns multi-source data into action you can run today.

What sales actually needs to see (and why it matters)

To move from “vague research” to a booked meeting, reps need specifics:

- Topics & questions the buyer has been researching (“sales automation for SDRs”, “outreach cadences”).

- Competitor context (“viewed X and Y on [review site] last week”).

- Trigger moments (new VP Sales hire → process revamp likely; funding → budget available).

- Web behaviour (visited Pricing twice; returned via brand search; downloaded integrations guide).

- People (names/roles of the buying group; who’s active; who usually signs).

Armed with this, your first email or call isn’t generic; it’s laser-relevant:

“Noticed you’ve been exploring automation and viewed competitor pages. Here’s a 2-minute rundown of how teams like yours cut admin by ~40% without changing CRM.”

Relevance + timing = replies.

Mini case study: meetings up, cycle down

A cybersecurity vendor moved from a single publisher feed to Zymplify’s multi-source model. In one quarter they:

- Identified 156 in-market accounts that their old set-up missed.

- Booked 43% more first meetings by engaging earlier.

- Cut average sales cycle by ~2 weeks thanks to better timing and context.

Nothing else changed — same team, same product, same targets. The lift came from seeing the full signal picture and acting faster.

Common pitfalls (and how to avoid them)

- Pitfall 1: Treating all sources equally. Some signals are stronger for your ICP. Weight and test accordingly.

- Pitfall 2: Dumping raw data on sales. Summarise the intent story (what, who, when, why now) and deliver it where reps work.

- Pitfall 3: Slow activation. If it takes days to build a list and launch a campaign, you’ve already lost the edge. Automate the hand-off.

- Pitfall 4: Counting leads instead of readiness. Track IQL→MQL→SQL conversion and time-to-first-touch as primary KPIs.

- Pitfall 5: Over-focusing on accounts, under-focusing on people. Tie account-level intent to contact-level decision-makers early.

Metrics to prove the impact (and keep the budget)

When you shift from single-source to multi-source, look for movement in:

- IQL volume & quality: High-fit accounts with rising intent.

- Time-to-first-touch: Minutes/hours instead of days.

- Reply and meeting rates: Should lift as relevance improves.

- IQL→MQL→SQL conversion: The critical signal-to-pipeline health check.

- Sales cycle length & win rate: Improved timing typically shortens cycles and lifts wins.

Report these monthly; they’re the clearest way to demonstrate that broader signal coverage = more, faster pipeline.

How to get started (this week)

- Audit your coverage. List every current source and map where it plays (early/mid/late journey). Spot your gaps.

- Add complementary feeds. If you’re heavy on review sites, add publisher + triggers and first-party web ID.

- Operationalise scoring. Use a simple matrix (intent x fit) — or the Research Quadrant™ — to prioritise.

- Automate activation. For top-right accounts, auto-launch a short, relevant sequence and alert an SDR.

- Tighten your feedback loop. Capture rep outcomes; re-weight signals; iterate weekly.

You’ll feel the impact quickly: more relevant conversations, earlier in the journey.

Conclusion: Don’t let partial data cap your pipeline

Single-source intent isn’t “wrong”; it’s incomplete. Buyers leave a trail across channels. When you connect those dots, you find more real opportunities earlier, arm sales with sharper context, and move deals faster. Multi-source intent isn’t about chasing every click — it’s about seeing the whole buyer and acting at the right moment.

Ready to see the whole picture — and act on it instantly?

🚀 Try Zymplify’s GTM Agent for free to unify 20+ intent signals, surface high-fit IQLs, and trigger outreach in minutes. Watch your pipeline get smarter, faster.

🔗 https://d36.co/1bV1m